Seth Rao

CEO at FirstEigen

How Data Quality Affects Medicare Star Ratings of Health Insurance Company?

In the context of health insurance companies, the quality of data utilized is one of the main determinants affecting the levels of the Medicare Star Ratings. It is a system for measuring the quality of Medicare Advantage and Prescription Drug Plans, using a 1 to 5 star rating system.

These ratings act as a critical guide to consumers as they seek out trustworthy healthcare plans and as a determinant in a company’s performance in business.

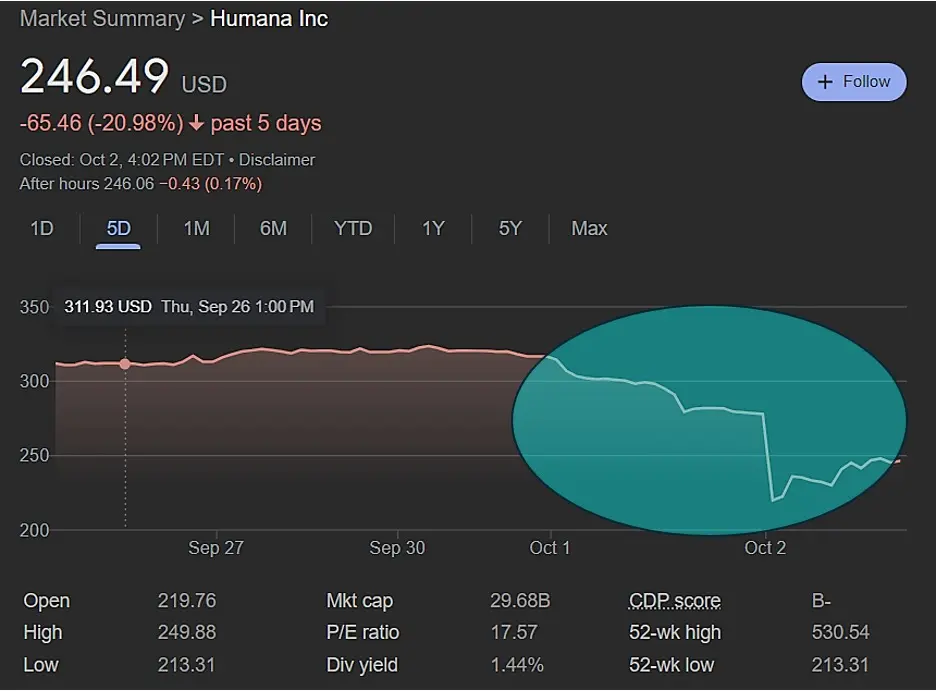

Humana posted huge losses in the market worth $6 billion as a result of downgrading its Medicare rating recently. This incident shows that quality of data in health insurance is of vital importance.

Humana’s Market Loss: A Clear Example

Between October 1 and 2, 2024, Humana recorded a decline of nearly $6 billion in its market capitalization when the company dropped from the high 5-star rating to 4 stars. In fact, before this downgrading, 95% of Humana’s customers were enrolled in the highest rated plans while after this downgrading, the figure crashed to 25%. Investors were reactionary to the downgrading, causing Humana’s shares to decrease by over 21% as a result of market sentiments.

As illustrated by the chart between late September and early October 2021, the shares of Humana stock on September 26 were worth $311.93, while by October 2, the price had dropped to $246.49. This drastic drop demonstrates how closely tied a company’s Medicare rating is to its market capitalization and investor confidence.

How Medicare Star Ratings Are Determined?

A score can be reached based on existing star ratings. These metrics rely on different health plan parameters whose performance will also determine the final score. The major contributors determining such ratings are:

- Healthcare Effectiveness Data and Information Set (HEDIS): Health care utilization measures that focus on the delivery of services and the effectiveness of health plans in the management of preventive services, chronic care and acute care.

- Consumer Assessment of Healthcare Providers and Systems (CAHPS): Obtaining information from patients about the medical care they receive through a health plan. This information is important as it attempts to portray the expectations of clients and what they actually experience, affecting the ratings on quality of services rendered.

- Health Outcomes Survey (HOS): This involves the evaluation of patient reported outcomes over the periods. Attention should be given to obtain accurate data in this area since bad health outcomes can affect the rating of a plan negatively.

- CMS Administrative Data: Includes a survey of headquarter activities such as audits, compliance filings and complaints from the patients. Such discrepancies in contacts records as well, and errors in this administrative data, may result in compliance and thus the overall Medicare rating also.

In summary, data as quality is one of the most critical attributes on which these ratings stand upon. Robust performance structures in this construct however are disabled by poor data accuracy and predictability.

Why is Data Quality Important?

These ratings are founded on data quality. Poor data accuracy or integrity can skew key metrics that include patient satisfaction, care management, and health outcomes. Some of the key ways through which data quality impacts ratings include:

- Customer Satisfaction: Inaccurate data about customer satisfaction skews the view of the plan’s effectiveness and results in lower rating.

- Care Coordination: Failure to track care coordination or outcome may misleadingly portray the performance of health providers, thus impacting ratings.

- Compliance and Audits: Administrative mistakes may lead to differences in compliance reporting and may also bring a blemish to the company’s rating in CMS evaluations.

On the other hand, data quality on high reflects the health insurance company and its capability of efficient care management, proper reporting, and customer satisfaction.

The top-rated companies, with four or five-star ratings, are well placed to attract as many customers as they can get, receive the additional financial bonus, and most importantly, have better reputations in the market.

Impact of Low Star Ratings

Like in the case of Humana, a rating downgrade by Medicare may have severe consequences for a business firm as well. This includes:

- Loss of Financial Incentives: Medicare pays more bonus and rebates to firms that it assigns higher ratings. These companies will lose such financial benefit, which would turn into revenues for them.

- Few enrollments: Consumers are attracted to very high-rated plans. A lower rating would likely yield fewer enrollments and lower market share for a company.

- Decline in Market Value: This is what faced Humana-the huge stock fall-as investors punish the firms that suffer rating downgrades, thereby forcing it to lose market confidence and more generally suffer financially.

Conclusion

Recent downgrades of Humana’s Medicare rating, that subsequently eroded in the market, makes a sterling example for all health insurance industries to understand the significance of data quality. For a health insurance provider, high-quality accurate data is necessary not only to sustain strong Medicare ratings but also to guard its market value and reputation.

Elevate Your Organization’s Data Quality With DataBuck

DataBuck enables autonomous data quality validation, catching 100% of systems risks and minimizing the need for manual intervention. With 1000s of validation checks powered by AI/ML, DataBuck allows businesses to validate entire databases and schemas in minutes rather than hours or days.

To learn more about DataBuck and schedule a demo, contact FirstEigen today.

Check out these articles on Data Trustability, Observability & Data Quality Management-

Discover How Fortune 500 Companies Use DataBuck to Cut Data Validation Costs by 50%

Recent Posts

Get Started!