Angsuman Dutta

CTO, FirstEigen

Managing Tariff Implications Through Data Integrity in Global Supply Chains

Introduction

In today’s global marketplace, supply chains span continents. From consumer electronics to industrial machinery, companies rely on global sourcing and distribution to stay competitive. But with this reach comes complexity—especially when it comes to tariffs.

As trade relationships evolve, so do tariff rules, which now vary by product type and country of origin. Staying compliant is no longer just about recordkeeping—it’s about data integrity at every level of the supply chain.

The Challenge: Evolving Tariffs and Rising Complexity

Modern tariff structures are increasingly dynamic. Countries like the U.S. are renegotiating agreements, imposing new rates, and adjusting requirements regularly. For companies, this means:

- Continuous reassessment of product classifications

- Tracking origin changes and supply shifts

- Ensuring customs declarations match evolving rules

The cost of error? Delays, audits, fines, or millions lost to incorrect duty payments.

Why Data Integrity Is Non-Negotiable

In this environment, data integrity isn’t a buzzword—it’s a business necessity.

Without clean, traceable, and accurate data, companies are vulnerable to:

- Misclassified tariffs

- Inaccurate country-of-origin tagging

- Compliance breaches

- Delays in customs clearance

The only sustainable way forward is to create a robust system where data is: ✅ Centralized

✅ Auditable

✅ Real-time

✅ Trusted across all functions

Case Study: FirstEigen’s Work with Global Supply Chains

At FirstEigen, we’ve helped organizations across sectors address this very challenge using our data trust platform, DataBuck. Here’s how two global clients tackled tariff complexity:

Case A: Cross-Border Electronics Manufacturer

- Operates across Asia (component sourcing), Mexico (assembly), and the U.S. (distribution)

- Faced misclassification risks due to dynamic country-of-origin dependencies

💡 DataBuck was used to:

- Automate validation of supplier and product master data

- Establish clear data lineage and transformation mapping

- Enable audit trail visibility for all compliance-critical fields

📈 Results:

- 96% improvement in data quality trust scores

- 70% reduction in compliance reporting time

- Zero audit issues in 12 months

Case B: Global Retailer Managing 100+ Product Lines

- Needed to manage tariff eligibility rules across various product categories and sourcing countries

- Previously relied on error-prone, manual systems

💡 DataBuck enabled:

- Real-time integration of tariff rules into data pipelines

- Proactive anomaly detection for customs-critical data

- One central dashboard for procurement, compliance, and finance

📈 Results:

- 90% reduction in tariff misclassification

- $3M in savings from duty optimization

- Faster customs clearances, enabling quicker time-to-market

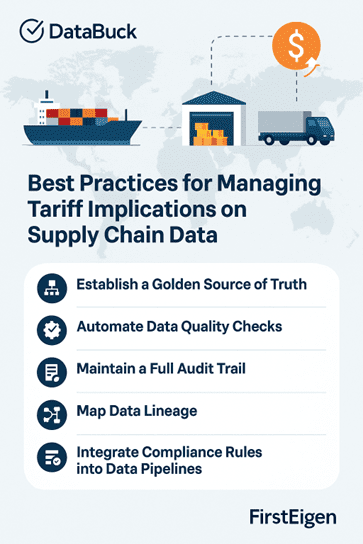

5 Best Practices for Tariff-Driven Data Compliance

Through these partnerships, we’ve identified key practices that drive results:

1. Establish a Golden Source of Truth

Consolidate and standardize master data across all systems to remove duplication and ambiguity.

2. Automate Data Quality Checks

Deploy AI-powered, continuous validation to catch errors in real time—before they cost you.

3. Maintain a Full Audit Trail

Capture every change with who, when, what, and why—so you’re always audit-ready.

4. Map End-to-End Data Lineage

Understand the entire journey of your data to ensure trust from source to declaration.

5. Embed Tariff Logic in Pipelines

Ensure compliance logic is baked into data workflows—not checked retroactively.

The Flexibility Factor: Why Adaptability is Key

The one certainty about tariffs? They will change.

As global negotiations continue, your systems must:

- Be able to update rules in real time

- Run “what-if” modeling to assess future impacts

- Share reliable metrics across all stakeholders

With platforms like DataBuck, you can future-proof your data infrastructure and gain operational agility.

Conclusion: Data-Driven Compliance Starts Now

In a world of shifting tariffs and growing complexity, the companies that will thrive are those that treat data not just as a resource—but as a strategic asset.

FirstEigen is proud to be powering smarter, cleaner, and more agile data operations for global supply chains. Our platform ensures that wherever trade rules go, your data stays accurate, traceable, and compliant.

📩 Contact us to learn how we can help your organization navigate tariff-driven change.

🔗 www.firsteigen.com | ✉ info@firsteigen.com

Discover How Fortune 500 Companies Use DataBuck to Cut Data Validation Costs by 50%

Recent Posts

Get Started!